Sonex Financial: Redefining Ethical Debt Recovery Through Specialist Vulnerability Services

How Sonex Financial Is Setting New Standards in Supporting Vulnerable Customers in Arrears

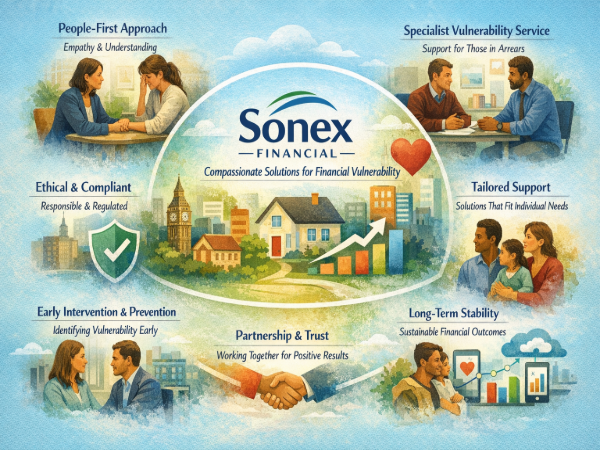

Sonex Financial is a UK-based specialist financial services provider known for its industry-leading vulnerability service designed to support customers who find themselves in arrears. Rather than relying on traditional debt-collection practices, Sonex Financial focuses on understanding personal circumstances, identifying vulnerability early, and delivering fair, sustainable outcomes for both customers and clients. Its people-first approach, strong compliance culture, and tailored engagement strategies have positioned Sonex Financial as a trusted name in ethical receivables management.

Table of Contents

ToggleIntroduction to Sonex Financial

Sonex Financial has built a strong reputation by challenging the traditional image of debt collection. Instead of focusing solely on recovery, the company places equal importance on empathy, understanding, and responsible engagement. In an industry often criticised for aggressive practices, Sonex Financial stands out by prioritising vulnerable customers who have fallen into arrears due to circumstances beyond their control.

The organisation works closely with partner companies to manage customer accounts at sensitive stages, ensuring that financial recovery does not come at the cost of dignity or wellbeing. This balanced approach has helped Sonex Financial gain recognition as a specialist provider that blends commercial responsibility with social awareness.

What Sets Sonex Financial Apart

The financial services sector is highly competitive, yet Sonex Financial differentiates itself through a clear mission: to deliver ethical, compliant, and compassionate solutions for customers in difficulty. The company does not believe in one-size-fits-all processes. Instead, it focuses on individual needs, recognising that vulnerability can take many forms.

From physical and mental health challenges to sudden changes in employment or personal circumstances, Sonex Financial trains its teams to identify and respond appropriately. This commitment to understanding the human side of financial difficulty is at the heart of its success.

Understanding Vulnerability in Financial Arrears

Vulnerability in financial contexts is not always visible. Customers may appear capable on the surface while quietly struggling with complex personal challenges. Sonex Financial acknowledges that vulnerability can be temporary, fluctuating, or long-term, and its systems are designed to adapt accordingly.

By recognising vulnerability early, Sonex Financial helps prevent situations from escalating. This proactive approach not only protects customers but also supports clients by improving long-term engagement outcomes and reducing unresolved arrears.

Sonex Financial’s Specialist Vulnerability Service

At the core of the company’s operations is its specialist vulnerability service. This service is specifically designed to support customers who have fallen into arrears and require a more sensitive, tailored approach. Rather than pushing for immediate repayment, Sonex Financial focuses on dialogue, understanding, and sustainable solutions.

The service is delivered by trained professionals who are skilled in communicating with vulnerable individuals. These teams take time to listen, assess circumstances, and explore realistic options that align with the customer’s ability to pay.

A People-First Approach to Debt Management

Sonex Financial believes that meaningful engagement begins with respect. Every interaction is guided by the principle that customers should feel heard, not pressured. This people-first philosophy shapes internal training, customer communications, and operational policies.

By fostering trust, Sonex Financial creates an environment where customers are more likely to engage openly. This leads to better outcomes for all parties, including improved repayment success and reduced emotional stress for customers.

Early Intervention and Prevention

One of the strongest aspects of Sonex Financial’s approach is early intervention. The company works to identify potential vulnerability before arrears become unmanageable. Early engagement allows for timely support, reducing the likelihood of long-term financial harm.

Preventative strategies include flexible communication methods, affordability assessments, and tailored repayment discussions. These measures demonstrate Sonex Financial’s commitment to responsible financial management rather than short-term recovery.

Compliance and Ethical Standards

Operating in a highly regulated environment, Sonex Financial maintains a strong compliance framework. The company ensures that all processes align with regulatory expectations and ethical best practices. Compliance is not treated as a checkbox exercise but as a core value embedded in daily operations.

This strong governance structure protects customers and clients alike, reinforcing Sonex Financial’s reputation as a trustworthy and responsible service provider.

Training and Expertise

The effectiveness of Sonex Financial’s services is driven by its people. Staff receive specialist training focused on vulnerability awareness, communication skills, and ethical engagement. This training equips teams to handle sensitive conversations with professionalism and empathy.

Continuous development ensures that employees stay informed about evolving standards and customer needs. As a result, Sonex Financial maintains a high level of service quality across all interactions.

Tailored Solutions for Sustainable Outcomes

Every customer’s situation is unique, and Sonex Financial reflects this understanding in its solutions. Repayment plans are designed to be realistic, affordable, and sustainable, avoiding unnecessary pressure that could worsen financial distress.

By focusing on long-term stability rather than short-term gains, Sonex Financial helps customers regain control of their finances while supporting clients in achieving responsible recovery.

Partnership-Driven Service Model

Sonex Financial works closely with partner organisations across various sectors. These partnerships are built on trust, transparency, and shared values. By acting as an extension of its clients’ customer care strategies, Sonex Financial enhances brand reputation while delivering specialist expertise.

Clients benefit from improved customer outcomes, reduced complaints, and stronger long-term relationships with their customer base.

Industry Recognition and Reputation

Over time, Sonex Financial has gained recognition for its innovative approach to vulnerability management. Its focus on ethical engagement and specialist services has positioned it as a respected voice within the industry.

This reputation is not built on marketing claims alone but on consistent performance, positive outcomes, and a clear commitment to doing the right thing.

The Role of Technology and Insight

While human interaction remains central, Sonex Financial also leverages data and insight to enhance its services. Intelligent systems help identify risk indicators, track engagement outcomes, and support informed decision-making.

Technology is used as a support tool rather than a replacement for human judgment, ensuring that every decision remains customer-focused.

Supporting Customers Beyond Repayment

Sonex Financial understands that financial recovery is often part of a broader personal journey. Where appropriate, the company encourages customers to seek additional support and take steps toward long-term financial wellbeing.

This holistic view reflects Sonex Financial’s belief that ethical financial services should contribute positively to people’s lives, not simply resolve balances.

Why Sonex Financial Matters in Today’s Economy

In times of economic uncertainty, more individuals face financial pressure. Sonex Financial plays a crucial role by offering a compassionate alternative to traditional collections, helping customers navigate difficult periods with dignity.

Its specialist vulnerability service addresses a growing need within society, making the company’s work increasingly relevant and impactful.

Future Vision of Sonex Financial

Looking ahead, Sonex Financial continues to invest in training, innovation, and service development. The company remains committed to refining its vulnerability services and setting higher standards for ethical engagement.

As expectations around responsible finance evolve, Sonex Financial is well positioned to lead through example, demonstrating that commercial success and social responsibility can go hand in hand.

Conclusion

Sonex Financial represents a modern, ethical approach to managing financial arrears. By placing vulnerability at the centre of its strategy, the company has redefined what responsible debt recovery looks like. Its specialist services, people-first philosophy, and commitment to sustainable outcomes make Sonex Financial a standout name in the industry.

For customers in arrears, Sonex Financial offers understanding rather than judgment. For partners, it delivers expertise, compliance, and improved outcomes. In an industry that demands trust, Sonex Financial continues to prove why it deserves it.